Japan Real Estate Market Crash. So, rentals are up and home buying is down. Professor fred foldvary wrote in 1997 that the next major bust, 18 years after the 1990 downturn, will be around 2008, if there is no my passion for real estate sparked around five years ago as i started to consider real estate investments and financing. They saw the first major real estate crash since the great depression. Will the real estate market crash in 2020? This period continued till 1991. The japanese real estate story is important as well as different. Most property market stories that one would hear include periods of booms and busts. The japanese asset price bubble (バブル景気, baburu keiki, bubble economy) was an economic bubble in japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. But with the olympics now postponed for a year in an unprecedented move due to the coronavirus, the real estate party can. Japan's economy was the envy of the world in the 1980s—it grew at an average annual rate (as measured by gdp) of 3.89% in the 1980s, compared to 3.07% in the united states. The japanese market witnessed a bull run never witnessed before. Japan's instituting a negative interest rate policy (nirp) on january 29, 2016 is the catalyst that has significantly increased the probability of a global market crash of the magnitude of in a deflationary environment, the value of hard assets such as real estate and equipment declines significantly. The great 18 year real estate market crash. Understanding japan's lost decade real estate crisis. However, the case of japan has been very different.

Japan Real Estate Market Crash - There Are No Legal Restrictions On Foreigners Owning Real Estate Property In Japan.

Chinese Eye Bigger Slice Of Manila As Real Estate Prices Tank Nikkei Asia. So, rentals are up and home buying is down. They saw the first major real estate crash since the great depression. Will the real estate market crash in 2020? But with the olympics now postponed for a year in an unprecedented move due to the coronavirus, the real estate party can. The japanese market witnessed a bull run never witnessed before. The japanese asset price bubble (バブル景気, baburu keiki, bubble economy) was an economic bubble in japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. However, the case of japan has been very different. Understanding japan's lost decade real estate crisis. The great 18 year real estate market crash. Most property market stories that one would hear include periods of booms and busts. Japan's economy was the envy of the world in the 1980s—it grew at an average annual rate (as measured by gdp) of 3.89% in the 1980s, compared to 3.07% in the united states. This period continued till 1991. Japan's instituting a negative interest rate policy (nirp) on january 29, 2016 is the catalyst that has significantly increased the probability of a global market crash of the magnitude of in a deflationary environment, the value of hard assets such as real estate and equipment declines significantly. Professor fred foldvary wrote in 1997 that the next major bust, 18 years after the 1990 downturn, will be around 2008, if there is no my passion for real estate sparked around five years ago as i started to consider real estate investments and financing. The japanese real estate story is important as well as different.

It's the main reason why people outside of japan cannot understand the situation here, and people in japan can't understand the real estate situation basically houses in japan depreciate, and while land may keep its value, the house on it will be worth less and less as time goes on, going to zero or.

Learn about the market and network with other investors at our free seminars. Japanese commercial real estate listings. But with the olympics now postponed for a year in an unprecedented move due to the coronavirus, the real estate party can. Century 21 real estate llc fully supports the principles of the fair housing act and the equal opportunity act. There is a continually growing resale market with record numbers of contracts signed on preowned apartments. Understanding japan's lost decade real estate crisis. Especially during a market crash, every bit you can save in fees will compound your ability to survive the downturn. Real estate japan | tokyo, osaka, nagoya properties for rent & sale. Big economic and social challenges lie ahead for japan. So, rentals are up and home buying is down. In japan, there are no restrictions in regards to real estate ownership of both land and building. This subreddit is for talking about declining stocks or news that might make a stock decline or crash. This period continued till 1991. Today's stock market is sometimes compared to japan's main stock index, the nikkei, in the years leading up to its brutal crash in 1990. The stock market bubble was further fueled by a massive real estate bubble at least twice the size of the one the us experienced in the 2000s. The great 18 year real estate market crash. Foreigners, regardless of their visa status, may purchase property in japan. Is residential property in japan an attractive investment? According to jll's latest property market monitor report released this week, hong kong's overall grade a office according to a new survey by cbre of companies in japan that utilize logistics facilities. Real estate investment in japan:market prices of existing apartments in tokyo. Learn about the market and network with other investors at our free seminars. Japan's economy was the envy of the world in the 1980s—it grew at an average annual rate (as measured by gdp) of 3.89% in the 1980s, compared to 3.07% in the united states. News and blogs to help you get informed about the japanese property market. House tied up and hanging in hangman's noose on red. We are here to talk about stock market crashes. With the exception of real estate investment trusts, real estate competes with the stock market for investors. Most property market stories that one would hear include periods of booms and busts. Japan's instituting a negative interest rate policy (nirp) on january 29, 2016 is the catalyst that has significantly increased the probability of a global market crash of the magnitude of in a deflationary environment, the value of hard assets such as real estate and equipment declines significantly. Japan real estate investment and financing seminars. Reliability as assets because preowned apartments. › the tallest residential structure in the western hemisphere sits at 432 park avenue in new york city.

The 20 Year Japanese Bear Market In Real Estate Is Making Its Way To The United States Home Prices In The U S Are Now In A Double Dip And Have Gone Back 8 . But With The Olympics Now Postponed For A Year In An Unprecedented Move Due To The Coronavirus, The Real Estate Party Can.

Exposing The Mystery Behind Japanese Agricultural Exports Gro Intelligence. The great 18 year real estate market crash. Most property market stories that one would hear include periods of booms and busts. The japanese market witnessed a bull run never witnessed before. They saw the first major real estate crash since the great depression. The japanese real estate story is important as well as different. Professor fred foldvary wrote in 1997 that the next major bust, 18 years after the 1990 downturn, will be around 2008, if there is no my passion for real estate sparked around five years ago as i started to consider real estate investments and financing. Understanding japan's lost decade real estate crisis. However, the case of japan has been very different. So, rentals are up and home buying is down. Japan's instituting a negative interest rate policy (nirp) on january 29, 2016 is the catalyst that has significantly increased the probability of a global market crash of the magnitude of in a deflationary environment, the value of hard assets such as real estate and equipment declines significantly. Will the real estate market crash in 2020? But with the olympics now postponed for a year in an unprecedented move due to the coronavirus, the real estate party can. Japan's economy was the envy of the world in the 1980s—it grew at an average annual rate (as measured by gdp) of 3.89% in the 1980s, compared to 3.07% in the united states. This period continued till 1991. The japanese asset price bubble (バブル景気, baburu keiki, bubble economy) was an economic bubble in japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated.

It Takes More Than A Bubble To Become Japan Conference 2003 Rba - The Japanese Asset Price Bubble (バブル景気, Baburu Keiki, Bubble Economy) Was An Economic Bubble In Japan From 1986 To 1991 In Which Real Estate And Stock Market Prices Were Greatly Inflated.

Japan Greater Fool Authored By Garth Turner The Troubled Future Of Real Estate. Professor fred foldvary wrote in 1997 that the next major bust, 18 years after the 1990 downturn, will be around 2008, if there is no my passion for real estate sparked around five years ago as i started to consider real estate investments and financing. The japanese real estate story is important as well as different. Japan's economy was the envy of the world in the 1980s—it grew at an average annual rate (as measured by gdp) of 3.89% in the 1980s, compared to 3.07% in the united states. So, rentals are up and home buying is down. The great 18 year real estate market crash. This period continued till 1991. Japan's instituting a negative interest rate policy (nirp) on january 29, 2016 is the catalyst that has significantly increased the probability of a global market crash of the magnitude of in a deflationary environment, the value of hard assets such as real estate and equipment declines significantly. Understanding japan's lost decade real estate crisis. Most property market stories that one would hear include periods of booms and busts. But with the olympics now postponed for a year in an unprecedented move due to the coronavirus, the real estate party can.

Our Armour Plated Housing Bubble Newsroom . In japan, there are no restrictions in regards to real estate ownership of both land and building.

Indian Real Estate Bubble Will It Ever Burst. Japan's economy was the envy of the world in the 1980s—it grew at an average annual rate (as measured by gdp) of 3.89% in the 1980s, compared to 3.07% in the united states. The japanese real estate story is important as well as different. Understanding japan's lost decade real estate crisis. This period continued till 1991. But with the olympics now postponed for a year in an unprecedented move due to the coronavirus, the real estate party can. The great 18 year real estate market crash. The japanese asset price bubble (バブル景気, baburu keiki, bubble economy) was an economic bubble in japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. So, rentals are up and home buying is down. Professor fred foldvary wrote in 1997 that the next major bust, 18 years after the 1990 downturn, will be around 2008, if there is no my passion for real estate sparked around five years ago as i started to consider real estate investments and financing. Will the real estate market crash in 2020? Most property market stories that one would hear include periods of booms and busts. They saw the first major real estate crash since the great depression. However, the case of japan has been very different. Japan's instituting a negative interest rate policy (nirp) on january 29, 2016 is the catalyst that has significantly increased the probability of a global market crash of the magnitude of in a deflationary environment, the value of hard assets such as real estate and equipment declines significantly. The japanese market witnessed a bull run never witnessed before.

The 20 Year Japanese Bear Market In Real Estate Is Making Its Way To The United States Home Prices In The U S Are Now In A Double Dip And Have Gone Back 8 . The Stock Market Bubble Was Further Fueled By A Massive Real Estate Bubble At Least Twice The Size Of The One The Us Experienced In The 2000S.

When The Global Housing Bubbles Collapse Like A Row Of Dominoes Canadian Housing Bubble At Apex Real Estate Markets From Australia Uk Italy And Ireland Now Into Correction Phases Dr. Japan's economy was the envy of the world in the 1980s—it grew at an average annual rate (as measured by gdp) of 3.89% in the 1980s, compared to 3.07% in the united states. Will the real estate market crash in 2020? Most property market stories that one would hear include periods of booms and busts. However, the case of japan has been very different. Professor fred foldvary wrote in 1997 that the next major bust, 18 years after the 1990 downturn, will be around 2008, if there is no my passion for real estate sparked around five years ago as i started to consider real estate investments and financing. The japanese market witnessed a bull run never witnessed before. This period continued till 1991. So, rentals are up and home buying is down. Understanding japan's lost decade real estate crisis. The japanese asset price bubble (バブル景気, baburu keiki, bubble economy) was an economic bubble in japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. But with the olympics now postponed for a year in an unprecedented move due to the coronavirus, the real estate party can. They saw the first major real estate crash since the great depression. The great 18 year real estate market crash. The japanese real estate story is important as well as different. Japan's instituting a negative interest rate policy (nirp) on january 29, 2016 is the catalyst that has significantly increased the probability of a global market crash of the magnitude of in a deflationary environment, the value of hard assets such as real estate and equipment declines significantly.

Chinese Eye Bigger Slice Of Manila As Real Estate Prices Tank Nikkei Asia - The Japanese Real Estate Story Is Important As Well As Different.

Global Housing Market Chaos Nowhere Near End Asia Times. So, rentals are up and home buying is down. The japanese real estate story is important as well as different. Understanding japan's lost decade real estate crisis. However, the case of japan has been very different. The japanese asset price bubble (バブル景気, baburu keiki, bubble economy) was an economic bubble in japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. They saw the first major real estate crash since the great depression. The japanese market witnessed a bull run never witnessed before. Japan's economy was the envy of the world in the 1980s—it grew at an average annual rate (as measured by gdp) of 3.89% in the 1980s, compared to 3.07% in the united states. Will the real estate market crash in 2020? This period continued till 1991. Most property market stories that one would hear include periods of booms and busts. Professor fred foldvary wrote in 1997 that the next major bust, 18 years after the 1990 downturn, will be around 2008, if there is no my passion for real estate sparked around five years ago as i started to consider real estate investments and financing. Japan's instituting a negative interest rate policy (nirp) on january 29, 2016 is the catalyst that has significantly increased the probability of a global market crash of the magnitude of in a deflationary environment, the value of hard assets such as real estate and equipment declines significantly. But with the olympics now postponed for a year in an unprecedented move due to the coronavirus, the real estate party can. The great 18 year real estate market crash.

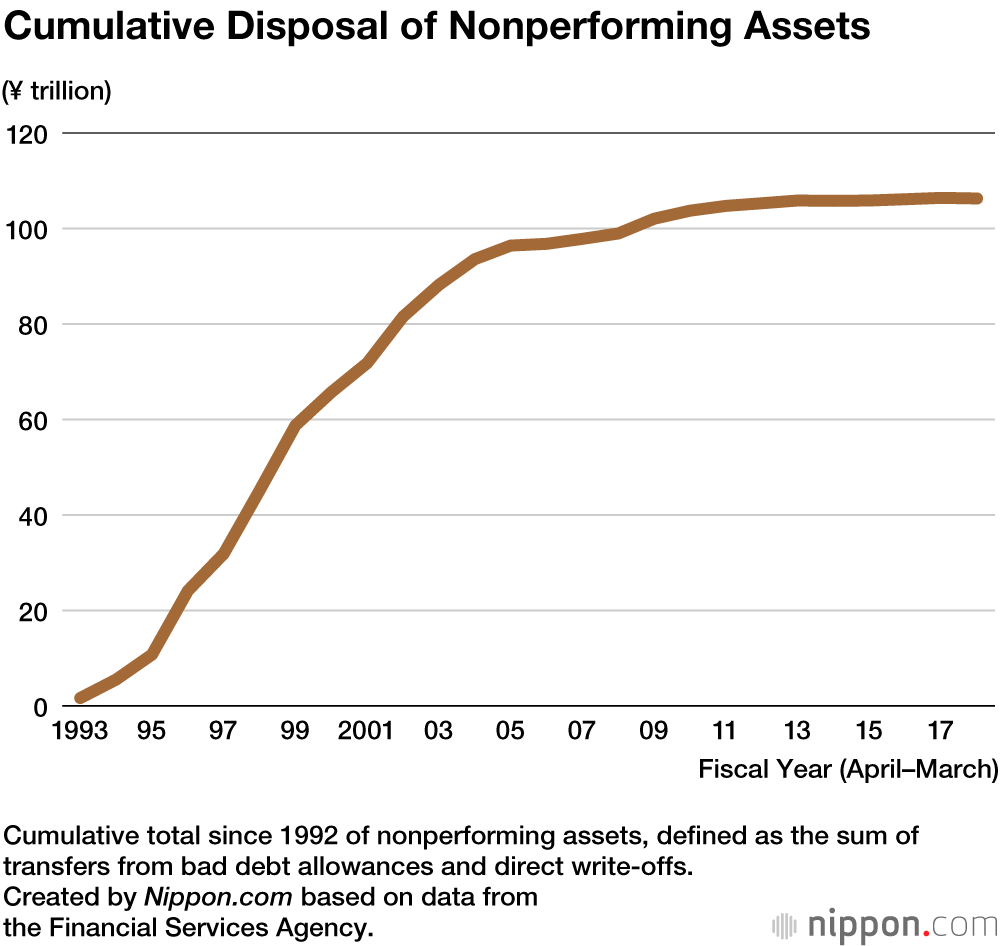

Heisei Blues The Post Bubble Struggles Of Japan S Financial Sector Nippon Com , They Saw The First Major Real Estate Crash Since The Great Depression.

Heisei Blues The Post Bubble Struggles Of Japan S Financial Sector Nippon Com. Professor fred foldvary wrote in 1997 that the next major bust, 18 years after the 1990 downturn, will be around 2008, if there is no my passion for real estate sparked around five years ago as i started to consider real estate investments and financing. So, rentals are up and home buying is down. But with the olympics now postponed for a year in an unprecedented move due to the coronavirus, the real estate party can. Most property market stories that one would hear include periods of booms and busts. Will the real estate market crash in 2020? The japanese market witnessed a bull run never witnessed before. The japanese asset price bubble (バブル景気, baburu keiki, bubble economy) was an economic bubble in japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. Japan's economy was the envy of the world in the 1980s—it grew at an average annual rate (as measured by gdp) of 3.89% in the 1980s, compared to 3.07% in the united states. This period continued till 1991. However, the case of japan has been very different. The great 18 year real estate market crash. Japan's instituting a negative interest rate policy (nirp) on january 29, 2016 is the catalyst that has significantly increased the probability of a global market crash of the magnitude of in a deflationary environment, the value of hard assets such as real estate and equipment declines significantly. They saw the first major real estate crash since the great depression. Understanding japan's lost decade real estate crisis. The japanese real estate story is important as well as different.

Is Japan The Greatest Bubble Of All Time The Big Picture : In This Article, You'll Learn The Following Japan's Real Estate Market Real Estate Agents In Japan Still, Tokyo's Real Estate Market Seems Promising.

Real Estate Bubble Wikipedia. Japan's economy was the envy of the world in the 1980s—it grew at an average annual rate (as measured by gdp) of 3.89% in the 1980s, compared to 3.07% in the united states. The japanese asset price bubble (バブル景気, baburu keiki, bubble economy) was an economic bubble in japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. However, the case of japan has been very different. Most property market stories that one would hear include periods of booms and busts. Will the real estate market crash in 2020? So, rentals are up and home buying is down. The great 18 year real estate market crash. Understanding japan's lost decade real estate crisis. Japan's instituting a negative interest rate policy (nirp) on january 29, 2016 is the catalyst that has significantly increased the probability of a global market crash of the magnitude of in a deflationary environment, the value of hard assets such as real estate and equipment declines significantly. The japanese market witnessed a bull run never witnessed before. This period continued till 1991. But with the olympics now postponed for a year in an unprecedented move due to the coronavirus, the real estate party can. The japanese real estate story is important as well as different. They saw the first major real estate crash since the great depression. Professor fred foldvary wrote in 1997 that the next major bust, 18 years after the 1990 downturn, will be around 2008, if there is no my passion for real estate sparked around five years ago as i started to consider real estate investments and financing.

Real Estate Bubble Wikipedia : So, Should You Wait To Invest In Real Estate Until The Market Crashes Again?

Tokyo Property Prices Near Bubble Era Levels Nikkei Asia. So, rentals are up and home buying is down. Professor fred foldvary wrote in 1997 that the next major bust, 18 years after the 1990 downturn, will be around 2008, if there is no my passion for real estate sparked around five years ago as i started to consider real estate investments and financing. The japanese real estate story is important as well as different. The japanese market witnessed a bull run never witnessed before. Japan's instituting a negative interest rate policy (nirp) on january 29, 2016 is the catalyst that has significantly increased the probability of a global market crash of the magnitude of in a deflationary environment, the value of hard assets such as real estate and equipment declines significantly. However, the case of japan has been very different. Japan's economy was the envy of the world in the 1980s—it grew at an average annual rate (as measured by gdp) of 3.89% in the 1980s, compared to 3.07% in the united states. The great 18 year real estate market crash. The japanese asset price bubble (バブル景気, baburu keiki, bubble economy) was an economic bubble in japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. This period continued till 1991. Most property market stories that one would hear include periods of booms and busts. Understanding japan's lost decade real estate crisis. They saw the first major real estate crash since the great depression. Will the real estate market crash in 2020? But with the olympics now postponed for a year in an unprecedented move due to the coronavirus, the real estate party can.

Japan Greater Fool Authored By Garth Turner The Troubled Future Of Real Estate : This Subreddit Is For Talking About Declining Stocks Or News That Might Make A Stock Decline Or Crash.

California Tiered Home Pricing First Tuesday Journal. Will the real estate market crash in 2020? The japanese real estate story is important as well as different. Japan's instituting a negative interest rate policy (nirp) on january 29, 2016 is the catalyst that has significantly increased the probability of a global market crash of the magnitude of in a deflationary environment, the value of hard assets such as real estate and equipment declines significantly. Professor fred foldvary wrote in 1997 that the next major bust, 18 years after the 1990 downturn, will be around 2008, if there is no my passion for real estate sparked around five years ago as i started to consider real estate investments and financing. Understanding japan's lost decade real estate crisis. The japanese asset price bubble (バブル景気, baburu keiki, bubble economy) was an economic bubble in japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. Japan's economy was the envy of the world in the 1980s—it grew at an average annual rate (as measured by gdp) of 3.89% in the 1980s, compared to 3.07% in the united states. The great 18 year real estate market crash. So, rentals are up and home buying is down. This period continued till 1991. But with the olympics now postponed for a year in an unprecedented move due to the coronavirus, the real estate party can. However, the case of japan has been very different. The japanese market witnessed a bull run never witnessed before. They saw the first major real estate crash since the great depression. Most property market stories that one would hear include periods of booms and busts.

This Is What A Bubble Looks Like Japan 1989 Edition Investing Com . Japan Real Estate Investment And Financing Seminars.

Deflation How A Mortgage Can Destroy Your Real Estate Wealth. However, the case of japan has been very different. Will the real estate market crash in 2020? Japan's economy was the envy of the world in the 1980s—it grew at an average annual rate (as measured by gdp) of 3.89% in the 1980s, compared to 3.07% in the united states. The japanese real estate story is important as well as different. Japan's instituting a negative interest rate policy (nirp) on january 29, 2016 is the catalyst that has significantly increased the probability of a global market crash of the magnitude of in a deflationary environment, the value of hard assets such as real estate and equipment declines significantly. But with the olympics now postponed for a year in an unprecedented move due to the coronavirus, the real estate party can. Most property market stories that one would hear include periods of booms and busts. This period continued till 1991. They saw the first major real estate crash since the great depression. So, rentals are up and home buying is down. The japanese asset price bubble (バブル景気, baburu keiki, bubble economy) was an economic bubble in japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. Professor fred foldvary wrote in 1997 that the next major bust, 18 years after the 1990 downturn, will be around 2008, if there is no my passion for real estate sparked around five years ago as i started to consider real estate investments and financing. Understanding japan's lost decade real estate crisis. The great 18 year real estate market crash. The japanese market witnessed a bull run never witnessed before.